What’s the Difference Between a 3% Fee and a 1% Fee? Over a Million Dollars!

Retirement isn’t something most people think about when they are young. It just seems so far away. But if you start investing early, the reward will be much larger.

When TI’s President and CEO, Haviv Ilan, recently received a handwritten letter (yes, handwritten!) explaining why it is so important for high school students to understand retirement savings and investments, he knew exactly what to do with it. He passed it on to the Education Technology division with employees who also understand the importance of financial literacy.

An interesting and unique story unfolds of Retired Air Force Major Harold Peters, the 90-year-old author of that letter. After speaking with him, we realized that his passion for financial literacy was not only inspirational, but that he was on to something. We immediately agreed: Everyone, including high school students, should be as informed as possible about their retirement savings.

Meet Harold Peters. He started investing in the late 1950s and early ’60s, but at that time there were large commissions and fees … sometimes as much as 8% per trade! So, he started to study retirement systems and over many years he recognized that fees can really put a dent in your retirement “nest egg.” When Harold realized that investment fees can do a lot of damage to his own investments, he started to alert people to start saving as soon as you can and avoid investing with professionals that charge high fees.

Much of Harold’s original work happened by thinking about different scenarios using a pencil, paper and slide rule. When handheld calculators became available, he switched over to a TI BA-35 and eventually TI-82 and TI-83 graphing calculators. TI graphing calculators allowed Harold to use the program editor to write his own retirement programs, which were developed from his “engineer’s perspective.”

“My main purpose of making this offer is to get this knowledge taught in high schools. They need this!” — Harold Peters

|

Harold’s mission: Get students thinking about retirement early

Even though retirement isn’t something most people think about when they are young, if you start investing early the reward can and likely will be much larger. How fast a nest egg grows depends on many factors, but one major factor that can shrink growth is commissions and fees that are often paid to organizations managing your money.

Little percentage fees make a huge impact over time.

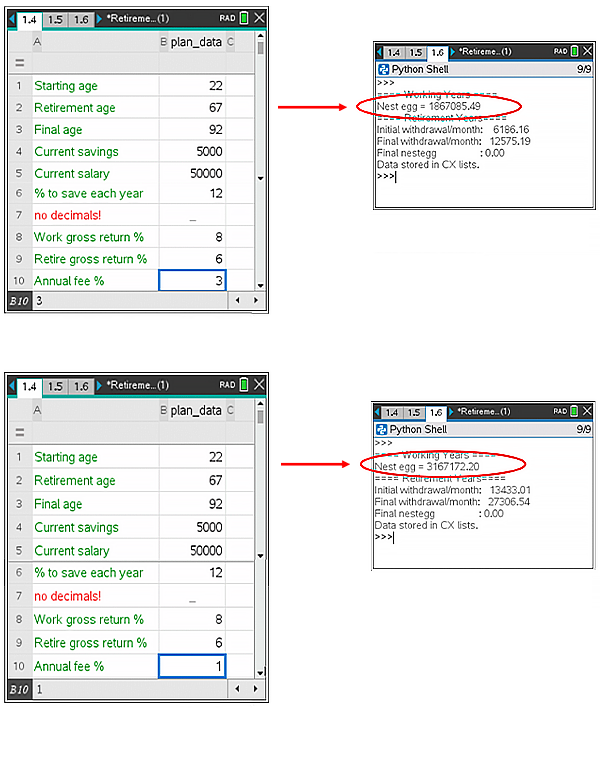

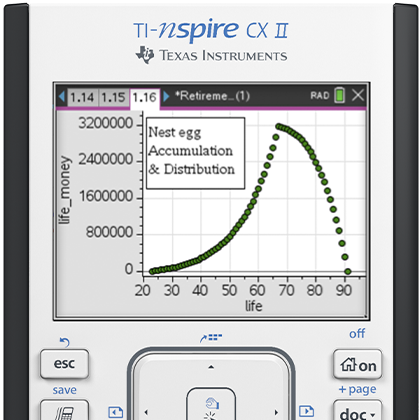

For example, let’s take a look at the “retirement planning” program that Harold and his son-in-law created.* You can easily see what kind of impact fees can have on your final nest egg.

Consider two scenarios where all inputs are the same. However, the first scenario is with a 3% annual fee and the second with a 1% annual fee. In the example of a 3% annual fee, a person will retire with $1.86 million. With a 1% annual fee, the total nest egg is over $3 million!

Introducing Garry Beckham, Harold’s son-in-law

Before we close out this blog post, it wouldn’t be fair for us not to mention Garry Beckham, Harold’s son-in-law. For the past 33 years, they have worked together to improve the algorithms and methodology. Garry is also a retired U.S. Air Force officer and flew F-4 fighter jets during his career. The images above depict Garry with his F4 Phantom fighter jet in the 1970’s and a more recent image of Garry in retirement.

Finally, we must include a disclaimer that Texas Instruments Education Technology division does not give financial advice to investors. However, we are excited to bring Harold and Garry’s approach to retirement planning to students. They are helping students understand how money works and why saving a part of every paycheck can lead to a nice retirement down the road.

Retirement planning activities using TI graphing calculators

You can find Harold and Garry’s retirement calculator on the TI Financial Literacy resources webpage under the “Lessons” tab.

These financial literacy resources also feature a lot of lessons to engage students in understanding money, as well as helpful how-tos and even some professional development opportunities. Helping teachers help their students learn these concepts just makes “cents”!

Download the retirement activities for your TI graphing calculator:

Activity files for TI-84 Plus CE Python graphing calculators

Activity files for TI-Nspire CX II graphing calculators

*Special thanks to John Hanna, the programming expert who converted the programs to Python. The programs are optimized to run on the latest TI products: TI-84 Plus CE Python and the TI-Nspire™ CX II graphing calculators.

About the author: Erick Archer is a Market Strategy Manager at Texas Instruments Education Technology and former science teacher.

Tags:

Tagcloud

Archive

- 2024

-

2023

- January (3)

- February (3)

- March (5)

- April (3)

- May (3)

- June (3)

- July (2)

-

August (6)

- 5 Ways to Spruce Up Your Classroom for Back to School

- Day of the Dog: Which Dog Is Roundest?

- Women Who Code: A TI Intern’s Fascinating STEM Journey

- 6 Sensational TI Resources to Jump-Start Your School Year

- 3 Back-to-School Math Activities to Reenergize Your Students

- A New School Year — A New You(Tube)!

- September (2)

- October (3)

- November (2)

- 2022

-

2021

- January (2)

- February (3)

- March (5)

-

April (7)

- Top Tips for Tackling the SAT® with the TI-84 Plus CE

- Monday Night Calculus With Steve Kokoska and Tom Dick

- Which TI Calculator for the SAT® and Why?

- Top Tips From a Math Teacher for Taking the Online AP® Exam

- How To Use the TI-84 Plus Family of Graphing Calculators To Succeed on the ACT®

- Celebrate National Robotics Week With Supervised Teardowns

- AP® Statistics: 6 Math Functions You Must Know for the TI-84 Plus

- May (1)

- June (3)

- July (2)

- August (5)

- September (2)

-

October (4)

- Transformation Graphing — the Families of Functions Modular Video Series to the Rescue!

- Top 3 Halloween-Themed Classroom Activities

- In Honor of National Chemistry Week, 5 “Organic” Ways to Incorporate TI Technology Into Chemistry Class

- 5 Spook-tacular Ways to Bring the Halloween “Spirits” Into Your Classroom

- November (4)

- December (1)

-

2020

- January (2)

- February (1)

- March (3)

- April (1)

- May (2)

- July (1)

- August (2)

- September (3)

-

October (7)

- Tips for Teachers in the time of COVID-19

- Top 10 Features of TI-84 Plus for Taking the ACT®

- TI Codes Contest Winners Revealed

- Best of Chemistry Activities for the Fall Semester

- Best of Biology Activities for the Fall Semester

- Best of Middle Grades Science Activities

- Best of Physics Activities for the Fall Semester

- November (1)

- December (2)

- 2019

-

2018

- January (1)

- February (5)

- March (4)

- April (5)

- May (4)

- June (4)

- July (4)

- August (4)

- September (5)

-

October (9)

- Art in Chemistry

- Which Texas Instruments (TI) Calculator for the ACT® and Why?

- Meet TI Teacher of the Month: Jessica Kohout

- Innovation in Biology

- Learning With Your Students

- A first-of-its-kind STEM strategy charts path to help educators

- #NCTMregionals Hartford 2018 Recap

- The Math Behind “Going Viral”

- Real-World Applications of Chemistry

-

November (8)

- Testing Tips: Using Calculators on Class Assessments

- Girls in STEM: A Personal Perspective

- 5 Teachers You Should Be Following on Instagram Right Now

- Meet TI Teacher of the Month: Katie England

- End-of-Marking Period Feedback Is a Two-Way Street

- #NCTMregionals Kansas City 2018 Recap

- Slope: It Shouldn’t Just Be a Formula

- Hit a high note exploring the math behind music

- December (5)

- 2017

- 2016

- 2015